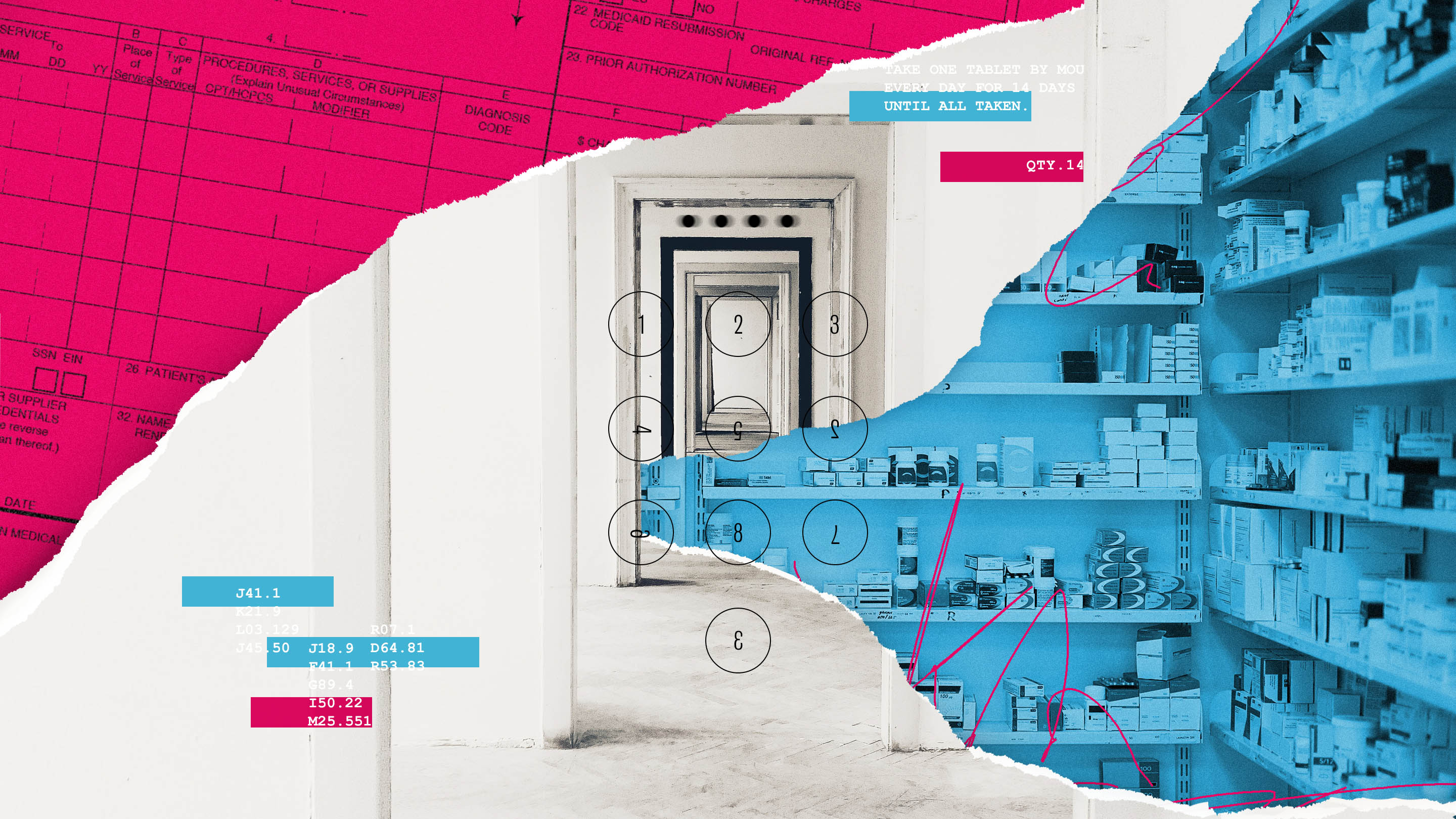

Medication Access Report

In this annual report, hear from patients struggling to get the medications they need, review data on major medication access challenges and discover healthcare solutions that can make a difference. Read the full report below or download the executive summary.

Barriers to Medication Access

The U.S. healthcare system can be difficult to understand. Navigating through layers of regulations and varying interests of disparate stakeholders is difficult for healthcare experts, let alone inexperienced, vulnerable patients.

For those in need of care, such complexity can fuel anxiety, uncertainty and distrust. This first installment of the annual Medication Access Report aims to bring attention to healthcare barriers that leave people without the medications they need to live healthy lives, while also introducing advances in healthcare IT that stand to make a positive impact.

Patients now expect transparency, accessibility and options as they journey along the healthcare continuum. To make informed healthcare decisions, patients need support and curated information. This report examines the trend of patient consumerism and how the market is responding with tools to empower patients through choice and visibility.

Ongoing inhibitors of efficient care and medication access, such as prior authorization (PA), can delay time to therapy for patients. This report also considers the healthcare impact of PA, describes technology that has made a positive difference so far and identifies where progress is still needed.

Additionally, as utilization of complex, specialty medications continues to increase, a growing need for next-generation patient support services to navigate unique healthcare challenges is described.

Contributions from all network participants, including providers*, pharmacies, payers and life sciences companies, are needed to overcome key disruptors to the patient journey that negatively influence outcomes. Within this report, industry statistics, market research and new survey data illustrate the need for network-driven change to break down the barriers to medication access and help improve the lives of patients. Detailed analysis of established and emerging healthcare IT solutions for these patient challenges is provided in topical, follow-up reports.

The Medication Access Report is developed in consultation with an advisory board of healthcare experts representing major organizations across the industry – each with unique perspectives, interests and opinions.

*We define “provider” as a prescriber and any member of their care team, inclusive of nurses, medical assistants, office managers and prior authorization specialists

Consumers in Healthcare

Choice and convenience are at an all-time high for the American consumer. In today’s digital age, many industries have gone above and beyond to understand what consumers want and meet them where they are – healthcare should be no different.

At all times, consumers must have a clear idea about what is available to them and how much it is going to cost. While healthcare has not kept pace with consumer demands so far, economic and social pressures are necessitating a change.

Listen to Bethany's struggle to access the prescribed medication she needs.

The Rise of Healthcare Consumerism

Current industry trends have created ideal market conditions for the rise of consumerism in healthcare. The U.S. Congressional Budget Office estimates that 173 million Americans under the age of 65 were covered through employer-based or non-group health insurance plans in 2019.Federal Subsidies for Health Insurance Coverage for People Under Age 65: 2019 to 2026, Congress of the United States, Congressional Budget Office, 2019 Of those with employer-based insurance, 45.6 percent are covered under high deductible health plans (i.e., deductible of at least $1,350 for self-only coverage and $2,700 for family coverage) per the U.S. Department of Health and Human Services – a more than 30 percent increase since 2007.High-deductible Health Plan Enrollment Among Adults Aged 18–64 With Employment-based Insurance Coverage, National Center for Health Statistics, CDC, U.S. Department of Health and Human Services, 2018,Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January–September 2018, Division of Health Interview Statistics, National Center for Health Statistics, 2019

Those under 65 and covered under high-deductible plans are estimated to account for 52 percent of all prescription volume in the U.S. (i.e.,~three billion prescriptions).Market Research, McKesson Corporation, 2020,Medicine Use and Spending in the U.S., A Review of 2017 and Outlook to 2022, IQIVIA Institute, 2018 As enrollment into high-deductible health plans continues to swell, deductible amounts are rising in tandem. In fact, year-over-year deductible growth since 2009 (162 percent) outpaces wage growth by more than six-fold (26 percent).Employees’ Share of Health Costs Continues Rising Faster Than Wages, Insurance Journal, 2018,Employer Health Benefits 2019 Annual Survey, Kaiser Family Foundation, 2019 In other words, patients are expected to pay disproportionately more out of pocket for their healthcare while receiving no additional funds to offset the cost.

Deductibles for traditional health plans are also climbing as the average for single coverage workers increased from $460 in 2007 to $1,153 in 2018 (i.e., a 124 percent increase) – only 27 percent less than high-deductible health plans after employer-sponsored health savings account contributions.High-deductible Health Plan Enrollment Among Adults Aged 18–64 With Employment-based Insurance Coverage, National Center for Health Statistics, CDC, U.S. Department of Health and Human Services, 2018 Some patients (e.g., 17 percent of commercially insured patients) can even pay a separate pharmacy deductible for prescription medications in addition to their regular deductible.2017 Trends in Drug Benefit Design Report, Pharmacy Benefit Management Institute, 2017

Monthly health insurance premiums are paid in addition to deductibles and continue to increase as well. In 2018, the average worker paid ~$575 per month in premiums for self-only coverage or $1,635 per month for family coverage, representing 54 percent and 62 percent increases since 2007 (relative to ~21 percent cumulative inflation rate), respectively.Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January–September 2018, Division of Health Interview Statistics, National Center for Health Statistics, 2019

The burdens of high deductibles and high premiums result in many Americans falling into an unfortunate category: underinsured. While it’s estimated that 30 million Americans are completely uninsured, as many as 86 million – nearly three-fold more – may be underinsured {i.e., commercial plans (45.6% x 159 million) and Marketplace plans via the Affordable Care Act (90% x 14 million)}.Federal Subsidies for Health Insurance Coverage for People Under Age 65: 2019 to 2026, Congress of the United States, Congressional Budget Office, 2019 Considering the total U.S. population (~330 million), this means that over one third of Americans are either uninsured or underinsured.

More specifically, a survey published in 2019 by The Commonwealth Fund found that ~44 million Americans fit at least one criterion of underinsured: out-of-pocket costs equaling 10 percent or more of their income (five percent or more if low-income) or deductibles equaling five percent or more of their income.Survey Brief Tables, Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured, The Commonwealth Fund, 2019,Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured, The Commonwealth Fund, 2019 In addition, 20 million others experienced an insurance coverage gap in 2018 and were responsible for all of their healthcare expenses during that time.Survey Brief Tables, Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured, The Commonwealth Fund, 2019,Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured, The Commonwealth Fund, 2019

Inadequate or spotty coverage has clear implications for finances and health. Nearly half of underinsured respondents in the survey reported difficulty paying for medical bills (~two times more than the adequately insured) and 41 percent admitted to delaying needed care due to cost considerations.Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured, The Commonwealth Fund, 2019

It is estimated that 30 million Americans are uninsured and as many as 86 million may be underinsured.

Beyond shifting industry trends in insurance coverage, social determinants including income, age and education can also impact patients’ health and ability to afford care – further priming market conditions for healthcare consumerism.Beyond Healthcare: The Role of Social Determinants in Promoting Health and Health Equity, Kaiser Family Foundation, 2018 For people earning less than 200 percent of the federal poverty line (about one third of the population), 14 – 19 percent of their income is applied to health insurance premiums and out-of-pocket medical expenses compared to only five – seven percent for people earning ≥400 percent of the federal poverty line.Looking at social determinants of health in the U.S. and comparable countries, Peterson-KFF Health System Tracker, 2019

Despite coverage through Medicare, older Americans have also reported difficulty in affording care with 21 percent claiming to spend more than $2,000 annually on out-of-pocket costs, while often living on a fixed income, and 19 percent admitting to skipping doses or care due to cost.Older Americans report more difficulty affording care than seniors in comparable countries, Peterson-KFF Health System Tracker, 2019

Taken together, such data underline a growing healthcare concern – patients are increasingly exposed to high out-of-pocket costs and this can delay or prevent needed treatment. As a group, high-deductible plan members and the uninsured account for ~116 million people that are fully exposed to healthcare expenses for at least part of the year.

It’s estimated that only one quarter to one third of high-deductible plan members even reach their deductible for a given year and the extrapolated date by which an average patient hits the average deductible has now extended late into May.Emergence and Impact of Pharmacy Deductibles: Implications for Patients in Commercial Health Plans, IQIVIA Institute, 2015,Industry Research, McKesson Corporation, 2020,Deductible Relief Day: How rising deductibles are affecting people with employer coverage, Peterson-KFF Health System Tracker, 2019

During the deductible period of health plans, when the cost of care falls entirely to the patient, prescription abandonment and medication non-adherence can climb significantly. In fact, one of four prescriptions are abandoned by patients during the deductible period, compared to only one in ten prescriptions when there is no deductible.Medicine Use and Spending in the U.S., A Review of 2016 and Outlook to 2021, IQIVIA Institute, 2017

Evidence suggests that prescription abandonment scales with out-of-pocket costs. For prescriptions under $50, abandonment (i.e., proportion of patients with approval from their insurer but do not initiate therapy) can range from eight percent ($0 – 9.99) to 21 percent ($40.00 – 49.99). As costs escalate beyond $250, prescription abandonment can reach 69 percent.Patient Affordability Part Two, Implications for Patient Behavior and Therapy Consumption, IQIVIA Institute, 2018 While a $250 claim may seem far-fetched, the average claim for patients with high deductibles and commercial insurance was $270 in 2017.Patient Affordability Part One, The Implications of Changing Benefit Designs and High Cost-Sharing, IQIVIA Institute, 2018

Empowering patients as consumers of health can help to ease the economic pressures burdening many patients – potentially improving their access to medications they need to live healthy lives. Prescription price transparency and affordability options for patients at each stage of their journeys may help mitigate the economic and social challenges that are exacerbated by high-deductible plans and rising out-of-pocket spending.

Data points (blue) adapted from IQIVIA analysis of brand name prescription abandonment by new patients as out-of-pocket costs increase.Patient Affordability Part Two, Implications for Patient Behavior and Therapy Consumption, IQIVIA Institute, 2018 To estimate the rate of prescription abandonment as a function of out-of-pocket costs, the data points were fit to an exponential equation, assuming an upper limit of 69 percent abandonment, to yield a prescription abandonment rate of 0.6 percent for every out-of-pocket dollar. For example, the model predicts that 12 percent of patients will abandon prescriptions costing $30 out of pocket, which closely agrees with the 14 percent of patients in the actual study.

Price Transparency and Choice at the Point of Prescribing

Compared to more commoditized industries, healthcare has been slow to adopt a mindset of consumer-centricity. For example, three out of four patients recall getting a prescription that cost more than they anticipated and one out of two admit to leaving the pharmacy empty-handed because a prescription was too expensive.2018 Real-Time Benefit Check National Adoption Scorecard, CoverMyMeds, 2018 Such data expose two problems uniquely affecting patients as a result of overdue consumerism in healthcare: lack of price transparency and lack of options (e.g., availability of alternative medications, availability of financial assistance, cash price information, etc.).

Many patients do not learn if a medication will be covered by insurance or how much they will pay out of pocket until they arrive at the pharmacy. For insured patients, prescription choice and availability are often limited by formulary status and tier placement of medications.A Brief History of Drug Formularies And What to Expect in 2019, CoverMyMeds, 2018

Each year, pharmacy benefit managers (PBMs) evaluate medications for inclusion or exclusion from their national formulary lists based on such factors as clinical efficacy, safety, cost and cost effectiveness. Those medications that are included on the formulary can be further stack-ranked into tiers based on payer/PBM preference (e.g., rebate negotiations).

If a prescribed medication is not on formulary or has unfavorable tier placement, the patient may need prior authorization (PA) to verify clinical necessity before their insurance will approve reimbursement – and even if approved, the patient can expect to pay more out of pocket at the pharmacy. In fact, 91 percent of insured workers are in insurance plans with two or more formulary tiers.Employer Health Benefits 2019 Annual Survey, Kaiser Family Foundation, 2019

Year over year, formulary exclusions of brand name medications continues to significantly increase. Some of the nation’s largest PBMs now exclude hundreds of products – exclusions for brand name medications increased as much as 63 percent in 2020.Express Scripts vs. CVS Health: Five Lessons From the 2020 Formulary Exclusions and Some Thoughts on Patient Impact, Drug Channels Institute, 2020 The rise in exclusions over the past few years may be tied to an increase in expensive specialty medications reaching the market with less-expensive therapeutic alternatives available.Formulary Drug Exclusions on the Rise: What Health Execs Should Know, Managed Healthcare Executive, 2018

Without awareness and support for accessing affordability options or lower-priced clinical alternatives, patients often sacrifice their health or personal circumstance to get the medications they need when a prescription is not covered or costs more than expected. In fact, a recent survey to 1,000 patients* found that 69 percent have made personal or financial sacrifices to afford prescribed medications that cost too much – over one third make this tough decision once a month or even more frequently.CoverMyMeds Patient and Provider Surveys, 2020 Nearly three of four patients (72 percent) also expressed some level of difficulty in affording their prescription medications while still paying toward their deductible.CoverMyMeds Patient and Provider Surveys, 2020

*See Research Methodology section for more details on how the patient and provider surveys were conducted.

When patients cannot afford their prescriptions, 52 percent seek affordability options through their provider – but 29 percent admit to just going without their medications.CoverMyMeds Patient and Provider Surveys, 2020

CoverMyMeds Patient and Provider Surveys, 2020.CoverMyMeds Patient and Provider Surveys, 2020

Supplying patients with more information and options earlier during their journey – while they are at their provider’s office – may help to limit sticker shock at the pharmacy and reduce risk of prescription abandonment. While many providers may have access to patient formulary and benefit information within their EHR systems, the scope of this data is limited. According to a recent survey to 400 providers, 79 percent seldom trust this information and 78 percent report that out-of-pocket costs are rarely or never available.CoverMyMeds Patient and Provider Surveys, 2020

Prescription decision support (PDS) is a strategy for improving medication access by supplying price transparency, affordability options and choice to providers in-workflow and to patients at any time during their care journey. PDS technologies deliver benefit details and off-benefit options that are useful for confident and informed healthcare decision-making. These tools can be applied at the point of prescribing and beyond to empower patients as consumers.

Real-time benefit check (RTBC) is a key component of PDS that provides benefit transparency and choice at the point of prescribing. By surfacing prescription coverage, accurate out-of-pocket costs and clinical alternatives, standard RTBC solutions can enable practical care conversations between patients and providers inclusive of clinical, financial and temporal factors. Some RTBC solutions can even provide off-benefit information, such as cash price for medications and availability of patient assistance programs, to give a more complete view of available options.

An overwhelming majority of surveyed providers (86 percent) agree that a reliable RTBC solution would benefit patients and assist them during prescription decision making.2018 Real-Time Benefit Check National Adoption Scorecard, CoverMyMeds, 2018 Over 70 percent of surveyed nurses consider it their responsibility to find prescription options that fit within patients’ unique coverage and financial situations.CoverMyMeds Nurses Survey, 2019

Without an RTBC solution, only 32 percent of nurses expressed satisfaction in their current ability to find information regarding their patients’ out-of-pocket costs for medications and only 33 percent were satisfied with their ability to find which medications were covered by their patients’ health plans.CoverMyMeds Nurses Survey, 2019 Finding such information can be difficult – 73 percent of nurses claim that what they need is not located in one single location and is instead scattered across multiple resources.CoverMyMeds Nurses Survey, 2019

Given that patients see providers as the most trusted healthcare stakeholder,Patient Services – Pharma’s Best Kept Secret, Accenture, 2015 RTBC can be a crucial resource for providers at a critical moment in the patient journey. For this reason, RTBC must provide accurate, comprehensive information every time it's needed – underlining the importance of high accuracy and response rates in RTBC solutions.

Instead of uncertainty about prescriptions, with patients unaware of their options and in the dark about what they will pay at the pharmacy, RTBC can create opportunities for patients to get the medications they need within the framework of their unique health, coverage and financial situations. For example, as many patients on fixed incomes or under financial strain struggle to afford their medications during the deductible period of their health plan, RTBC can empower them with cheaper options (e.g., generic alternatives, patient assistance programs, etc.) that may work within their budgets.

Other people may never reach their deductible in a given year. For such instances, it may make more sense to pay for medications off-benefit if the cash price is cheapest, which happens more often than many realize.Overpaying for Prescription Drugs: The Copay Clawback Phenomenon Where RTBC solutions may be limited in helping these patients, PDS solutions can give insight into such off-benefit details.

Effective RTBC solutions can alert providers to formulary restrictions or exclusions while offering options to begin a PA request electronically, at the point of prescribing, or switch to an on-formulary clinical alternative. While some patients may be comfortable waiting for a PA request to be approved, others may want their medication as soon as possible. In such a case, providers may suggest clinical alternatives to avoid PA and any potential delay in time to therapy. By moving the decision to begin or avoid PA to the point of prescribing, RTBC offers a long-term strategy for mitigating and streamlining PA volume that still largely occurs at the pharmacy.

For additional details on the features and capabilities of RTBC solutions, along with a look at how healthcare stakeholders contribute and benefit, read our 2020 report on prescription decision support.

Price Transparency and Choice at Any Time

Through online retailers like Amazon, consumers are accustomed to evaluating products on factors like quality, convenience and price before making a selection and purchase. Unfortunately, this level of price transparency and choice for prescription medications is scarcely available in healthcare to this point.

While RTBC technology is empowering decision making at the point of prescribing, extending prescription decision support to any stage of the patient journey will have the most impact for helping patients get the medications they need to live healthy lives.

Before leaving the provider’s office, patients are typically asked their preference for where prescriptions should be sent. For many, the answer to this question is the first large chain pharmacy that is familiar or perceived as convenient to them.

Unfortunately, patients may not be aware that this choice can impact their out-of-pocket costs. As an unintended consequence, patients may perceive that there are no other options for where/how to fill (e.g., preferred pharmacies, mail-order pharmacies, price shopping apps, etc.).

Growth in preferred pharmacy networks for Medicare Part D plans.Preferred Pharmacy Networks Rebound in 2020 Medicare Part D Plans: Details on WellCare, CVS Health, Humana, Cigna, and More, Drug Channels Institute, 2019

For several years, commercial and government-sponsored payers/PBMs have trended towards narrower pharmacy networks by incentivizing patients to fill prescriptions at a preferred pharmacy.2017 Trends in Drug Benefit Design Report, Pharmacy Benefit Management Institute, 2017,Preferred Pharmacy Networks Rebound in 2020 Medicare Part D Plans: Details on WellCare, CVS Health, Humana, Cigna, and More, Drug Channels Institute, 2019,Yes, Commercial Payers Are Adopting Narrow Retail Pharmacy Networks, Drug Channels Institute, 2017

A preferred pharmacy network attempts to give patients more choice for where to pick-up their prescription based on lowest out-of-pocket cost. This is in contrast to an open pharmacy network where patient out-of-pocket costs are the same at all network pharmacies with factors like name-recognition, service, convenience and location influencing choice, instead of price.Preferred Pharmacy Networks Rebound in 2020 Medicare Part D Plans: Details on WellCare, CVS Health, Humana, Cigna, and More, Drug Channels Institute, 2019

From 2011 to 2020, the number of Medicare Part D sponsored prescription drug plans with a preferred pharmacy network increased from seven percent to 95 percent.Preferred Pharmacy Networks Rebound in 2020 Medicare Part D Plans: Details on WellCare, CVS Health, Humana, Cigna, and More, Drug Channels Institute, 2019 In addition, 74 percent of commercial payers reported using a narrow pharmacy network in 2017 – a 24 percent increase from the previous year – and more are considering this change.2017 Trends in Drug Benefit Design Report, Pharmacy Benefit Management Institute, 2017,Yes, Commercial Payers Are Adopting Narrow Retail Pharmacy Networks, Drug Channels Institute, 2017

As it can be difficult to know off-hand which pharmacies are preferred by their insurance, patients often end up spending more. In fact, commercially-insured patients that used an out-of-network pharmacy in 2018 paid 36 percent more in out-of-pocket costs for their medications.2017 Trends in Drug Benefit Design Report, Pharmacy Benefit Management Institute, 2017

In a recent survey, 1,000 patients were asked to rank factors considered when managing their prescription medications by relative importance.CoverMyMeds Patient and Provider Surveys, 2020 Paying the lowest price (i.e., cheapest out-of-pocket cost) was the top response followed by receiving medications as soon as possible and confirming insurance coverage. Such data demonstrates that patients share similar values to consumers: cost, convenience and transparency.

By giving patients more control over their prescriptions, it may be possible to improve price transparency and choice at any time during their journeys. Instead of blindly sending prescriptions to any pharmacy, new PDS technologies empower patients to select a method to fill prescriptions that best considers their unique situations through a convenient mobile app that can be accessed at any time.

Based on survey responses from 1,000 patients taking prescription medications.CoverMyMeds Patient and Provider Surveys, 2020

While price shopping apps already allow patients to compare cash prices at different pharmacies and sometimes offer discounts,Blink Health vs GoodRx Gold: The Ultimate Showdown, The Frugal Pharmacist, 2019 next-generation PDS tools allow patients to view prescriptions in the context of their insurance benefit as well. Patients are presented with how much prescriptions cost out of pocket at various pharmacies (e.g., brick-and-mortar stores or mail-order) through insurance or outside of insurance (i.e., cash price) and see availability of patient assistance programs that can help offset expenses.

Remaining deductible amounts are shown so that patients can decide for themselves if it makes sense to use their insurance benefit (and apply payments toward the deductible) or if it saves money to purchase medications off-benefit with cash. In some cases, steep discounts to the cash price of brand name medications are even available.Shop Your Medicine Before Getting to the Pharmacy, ScriptHero, 2019

By placing prescriptions in their hands and enabling visibility through technology, patients are truly empowered to be consumers – making healthcare decisions based on how they personally prioritize such factors as cost, convenience and coverage.

To learn more about PDS tools that span the entire access journey for patients, from when a prescription is written to when it’s in hand, read our 2020 report on prescription decision support.

The Need for Technology Advancement and Adoption

Some medication access barriers can delay time to therapy for patients while also straining healthcare stakeholder workflows.

Prior authorization (PA) has been used to safely and economically manage utilization of prescription medications since the 1960’s but can be a slow and burdensome process when completed manually.A Brief History of How We Got to Electronic Prior Authorization, CoverMyMeds, 2017 Through advances in healthcare IT, electronic prior authorization (ePA) has simplified and expedited this process for the entire healthcare network.

Efforts from industry stakeholders and legislators have driven widespread adoption of ePA technologies – producing value, improved workflows and accelerated time to therapy. For ePA to continue having a positive impact on healthcare, provider adoption of the technology remains a key initiative.

Listen to Tonia's struggles with prior authorization while trying to access the prescription medication her son needs.

Administrative Constraints to Medication Access

Prior authorization is a tool used by payers/PBMs to make coverage determinations and to verify clinical decisions of healthcare providers. When PA is required for a prescription medication, providers must fill out a request form and send it to the payer/PBM for a determination.

The patient can expect insurance coverage for the medication only after the PA request receives an approval determination from the health plan. For denied PA requests, determinations can be appealed for another chance at coverage – otherwise, a different medication must be prescribed, or the patient must pay for the medication out of pocket.

A prescribed medication can require PA for a variety of reasons – to name a few, it may not be on formulary yet (e.g., new-to-market medications), it may be excluded from formulary, the medication quantity may need authorization or there may be step-therapy requirements (i.e., other medications must be tried first). From 2014 to 2020, the number of medications added to the formulary exclusion lists for several large PBMs increased more than 516 percent.Express Scripts vs. CVS Health: Five Lessons From the 2020 Formulary Exclusions and Some Thoughts on Patient Impact, Drug Channels Institute, 2020,The De-List: How Formulary Exclusion Lists Deny Patients Access to Essential Care, The Doctor Patient Rights Project, 2017,Express Scripts Announces Formulary Exclusions for 2019, Drops Nearly 50 Drugs, First Report Managed Care, 2018

It is estimated that formulary exclusions in 2018 impacted 2.5 percent of members,Insights into the 2019 PBM Formulary Changes, Pharmaceutical Strategies Group, 2018 which across the nation’s largest PBMs equates to nearly six million covered lives.Pharmacy Benefit Managers, Health Affairs, 2017 Given these formulary changes, the impact of PA on healthcare stakeholders and patients can only increase. Supporting this assertion, a survey from the American Medical Association published in 2019 found that 88 percent of providers agree that the burden associated with PA has increased over the past five years.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019

While prescribing a medication, providers are often unaware if PA will be required. As a result, PA requests are typically started at the pharmacy when patients’ insurance claims are rejected (e.g., pharmacy reject codes 70, 75, 76, MR). Without an electronic solution, the standard PA process involves a series of back-and-forth phone calls and faxes among the pharmacy, provider and payer to complete the request.

When the pharmacy first notifies the provider that PA is needed, the provider must then find and complete the correct PA request form specific to the medication and patient’s health plan. For providers, this can require significant effort to research on their own or significant time as they call the plan for answers. Providers report spending an average of two business days a week (14.9 hours) completing PA requests and 86 percent claim that the PA burden for their office is high or extremely high in 2019.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019 In another survey, 71 percent of nurses were less than satisfied with the amount of time they spend on the phone dealing with insurance issues, such as PA.CoverMyMeds Nurses Survey, 2019

Delays in time to therapy and burden to healthcare stakeholders as a result of manual PA has direct implications on quality of patient care. For example, 91 percent of providers admit to PA-related delays in patient care and 28 percent reported that such delays have led to serious adverse events for patients.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019 On the whole, 91 percent of surveyed providers asserted that PA can have a significant or somewhat negative impact on clinical outcomes for patients.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019 As PA requests can be troublesome to complete, providers often switch a prescribed medication to an alternative just to avoid PA. In fact, one early study reported that 76 percent of providers switch to a different medication when PA is required for their first prescription choice.The Impact of the Prior Authorization Process on Branded Medications: Physician Preference, Pharmacist Efficiency and Brand Market Share, Frost & Sullivan, 2013 It is unclear how altering primary treatment choice to avoid PA impacts patient health.

Based on a survey to 1,000 providers from the American Medical Association.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019

For patients at the pharmacy expecting to leave with their medications in hand, PA creates an access barrier that can often lead to prescription abandonment. In fact, it is estimated that seven percent of all prescription claims are rejected due to PA and 37 percent of those prescriptions are abandoned by patients.CoverMyMeds data on file, 1, 2020 As 5.8 billion prescriptions were dispensed in 2018,Medicine Use and Spending in the U.S., A Review of 2018 and Outlook to 2023, IQIVIA Institute, 2019 PA could be the cause of over 150 million patients not getting their prescribed medications. Such data is supported by provider sentiment from a recent survey in which 95 percent of respondents reported that PA can lead to prescription abandonment.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019

Many patients must balance their preference for therapy with delaying time to therapy as a result of PA. Nearly one third of patients in a new survey expressed their preference to remain on their providers’ first choice of therapy if it were no longer covered and 55 percent of patients reported delay in receiving medications while waiting for PA requests to be approved during the last year.CoverMyMeds Patient and Provider Surveys, 2020

While PA-related challenges frustrate healthcare stakeholders and patients, ePA technology offers a quick and efficient method for completing PA requests. As a result, few healthcare advances have quickly gained as much support and widespread stakeholder adoption as ePA.

Evolution of Electronic Prior Authorization

In 2011, the American Medical Association released a white paper urging the federal government and the healthcare industry to develop standards and technology for real-time transmission and processing of PA requests.Standardization of prior authorization process for medical services white paper, American Medical Association, 2011 This recommendation was the culmination of years of frustration and dedicated efforts from industry stakeholders. Today, nearly 100 percent of pharmacies, pharmacy system vendors, payers/PBMs and electronic health records (EHR) systems are integrated with an ePA solution and legislation at the federal and state levels requires the use of standardized, electronic methods to complete requests.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019

Over time, the use of standard PA request forms have evolved along with a four-part electronic transaction developed by the National Council for Prescription Drug Programs (NCPDP) termed the SCRIPT-standard.SCRIPT Electronic Prior Authorization Transactions Overview, National Council for Prescription Drug Programs, 2013 Such progressive standards help to encourage consistent payer forms, drug-specific PA criteria and real-time determinations on PA requests.

The widespread success of ePA can be partly attributed to the value it brings to all areas of the healthcare network while achieving the common goal of helping patients get the medications they need to live healthy lives. By simplifying and streamlining the PA process, ePA creates efficiencies within stakeholder workflows that saves time and limits administrative costs.

Percent of EHR, Payer and Pharmacy markets available with an ePA solution.

For example, a major ePA web portal serves as a central database for all payer PA forms that 73 percent of nurses regularly use for navigating medication access for patients, according to a recent survey.CoverMyMeds Nurses Survey, 2019 Such features limit time consuming phone calls (estimated at 50 minutes per callStandardization of prior authorization process for medical services white paper, American Medical Association, 2011) between providers and payers for confirming PA necessity and filling-out request forms.

Through ePA, providers can easily locate correct forms, auto-populate patient information and complete any called-out, required fields. It is estimated that providers save an average of 15 minutes and as much as nine dollars per PA request when completed electronically.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019,2019 CAQH Index Report, CAQH, 2019

Payers/PBMs see similar boosts to productivity through ePA. A case study found that ePA functionality reduced PBM call center volume by 22 percent while allowing case workers to initiate requests in less than 60 seconds.Case Study: PA Starter, CoverMyMeds, 2017 As a result, it is estimated that payers save as much as $25 per PA request when completed electronically.2019 CAQH Index Report, CAQH, 2019,Electronic prior authorization and payers: Lessons from BCBS, Managed Healthcare Executive, 2016 Through ePA, payers have the ability to pre-set authorization criteria and enable auto-determination for requests.

This capability permits real-time approvals so that patients can get their medications with little or no delay. In fact, a study found that auto-determination improved turnaround times for PA requests, allowing for same-day medication dispense to more patients relative to manual PA processes, like phone or fax.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019

Electronic prior authorization empowers pharmacists to better manage PA volume that begins at the pharmacy. As the majority of PA volume is considered retrospective (i.e., begins at the pharmacy, after claim rejection), pharmacists have traditionally served as liaison between providers and payers for millions of PA requests each year. The associated administrative workload contributed to nearly three quarters of surveyed pharmacists expressing a desire to spend less time dealing with insurance activities and more time counseling patients.AmerisourceBergen Pharmacy Check-Up: Activities and Barriers to Care Analysis, AmerisourceBergen Corporation and Maru/Matchbox, 2018

In the short-term, ePA has allowed pharmacies to easily initiate PA requests for providers to complete – helping to mitigate challenges accompanying excessive retrospective PA volume. In some cases, intelligent ePA technology can even recognize if prescriptions will require PA and automatically initiate requests electronically. In the long-term, ePA enables a strategy to divert retrospective PA volume at the pharmacy to the point of prescribing (i.e., prospective ePA) through combination with PDS tools, like RTBC.

On average, prospective ePA led to patients receiving their medications ~13 days faster relative to retrospective ePA in a health system case study.CoverMyMeds data on file, 1, 2019 As providers gain more confidence in the accuracy and response rates of RTBC solutions, it is expected that more PA requests will be begin prospectively at the point of prescribing or averted entirely to the benefit of pharmacies.

Accurate RTBC solutions can help limit false-positive PA notifications that contribute to unnecessary PA requests while giving providers confidence to start requests prospectively. During three months of simultaneous use at a health system, ePA and RTBC were coupled to increase the submission of prospective PA requests by five percent.CoverMyMeds data on file, 2, 2019

While the value of ePA has incentivized healthcare stakeholder adoption, legislative efforts at the federal and state levels further moved the needle by mandating ePA across the nation. Given its successful rise over the past decade, ePA serves as an instructive example for how to achieve change in healthcare that has a positive impact on patient health. For more information on how ePA brings value to entire healthcare network, read our 2020 report on ePA.

Provider Adoption of Electronic Prior Authorization

Despite industry-wide availability of ePA, approximately half of all PA volume still occurs through outdated phone and fax channels.CoverMyMeds data on file, 2, 2020 Such data indicates potential lack of provider awareness or misconceptions about ePA capabilities. Continued legislative progress and operational changes by industry stakeholders can direct more PA requests to be completed electronically – helping to propel maximum value for the entire healthcare network.

Recent surveys have probed both reasons why providers choose to use ePA and, more importantly, situations when ePA is not preferred or is perceived as insufficient.

Thousands of PA requests were completed electronically or by fax machine and the time to receiving a determination was recorded for each.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019

While ~70 percent of providers ranked the abilities of ePA to save time and return faster determinations as top benefits, a major reason for not using ePA involved the perception that urgent requests are better resolved over the phone.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019 In contrast to this popular belief, ePA returns faster determinations than other channels and functions well for urgent requests as well. In a head-to-head study tracking over 150,000 PA requests, 86 percent of those completed electronically received a determination within one day of submission compared to only 46 percent of those completed manually.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019

When confronted with specialty medications, unusual circumstances or specific health plans, providers also reported using methods other than ePA. As these scenarios fall outside of typical workflows, providers may not be aware that ePA can still provide an ideal solution. In fact, certain ePA solutions are compatible with all payers and any medication – including specialty medications covered under the pharmacy benefit.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019 Since 2014, PA volume for specialty medications through a large ePA vendor increased over 1,000 percent.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019 Continued advances in ePA technology even allow providers to leverage dynamic form fields and attach clinical documents to assist in completion of any unusual requests.

Beyond promoting awareness of the capabilities and associated benefits of ePA, continued legislative efforts and operational changes from industry stakeholders can help to move the needle towards complete provider adoption.

In 2019, Congress passed H.R.6 which contained a provision stipulating use of ePA for medications covered under Medicare Part D.2019 ePA National Adoption Scorecard, CoverMyMeds, 2019 As government-sponsored payers make appropriate changes to comply with this legislation, commercial payers will likely follow suit. Such incremental advances will encourage provider adoption as payers explicitly direct PA volume through the electronic channel.

As health systems create significant PA volume, they represent major opportunities for provider adoption of ePA. According to the American Medical Association, an average provider completes around 31 PA requests per week.2018 AMA Prior Authorization (PA) Physician Survey, American Medical Association, 2019 Considering that health systems employ hundreds of providers, these sites of care generate significant PA volume.

As a result, providers are turning to centralized teams dedicated to managing PA requests and associated administrative work for entire health systems. By integrating ePA as a key component of centralized team workflow, meaningful progress towards widespread provider adoption can be made.

For more details on current efforts to promote provider adoption of ePA, read our 2020 report on ePA.

The Need for Next-Level Patient Support for Specialty Medications

Due to their complexity, associated health risks and high costs, specialty medications pose significant access barriers to patients.

Compounding factors including clinical requirements, enrollment processes, reimbursement/coverage issues and communication breakdowns can prove difficult for patients to navigate on their own – contributing to prescription abandonment, medication non-adherence and poor health outcomes.

Patient support services (i.e., hubs) offered by manufacturers or third-party vendors are designed to guide patients through challenges and fulfill all requirements necessary to begin specialty therapies. However, patient awareness of these services is limited and deficiencies in the traditional hub model can frustrate patients and even delay time to therapy.

Emerging next-generation patient support services leverage technology to accelerate slow processes and provide visibility into the patient journey for specialty medications.

Listen to Kelly's difficult journey to access, afford and adhere to her specialty medication.

The Rise of Specialty Medications

Specialty medications accounted for 45.4 percent ($218.6 billion) of total pharmacy spending ($482 billion) in 2018, while accounting for only 2.2 percent of prescription volume.Medicine Use and Spending in the U.S., A Review of 2018 and Outlook to 2023, IQIVIA Institute, 2019,Specialty Drug Spend Soars. Can Formulary Management Bring It Down to Earth?, Managed Care, 2019 While high and rising prices were thought to be the primary factors contributing to such growth, recent data indicates that utilization of specialty medications has increased at more than twice the rate of traditional medications.Medicine Use and Spending in the U.S., A Review of 2018 and Outlook to 2023, IQIVIA Institute, 2019

In the past, specialty medications were seldom prescribed – often limited to small patient populations for such rare diseases as hemophilia, human immunodeficiency virus (HIV), multiple sclerosis (MS) and Gaucher’s disease.The Evolution of Specialty Pharmacy, Biotechnology Healthcare, 2008 Through continued research into rare (i.e., ~7,000 diseases affecting less than 200,000 people) and complex diseases (e.g., cancer, inflammatory conditions), more specialty medications are reaching the market.FAQs About Rare Diseases, Genetic and Rare Diseases Information Center, U.S. Department of Health and Human Services, 2017 During the early 1990’s there were fewer than 30 specialty medications approved by the FDA.The Evolution of Specialty Pharmacy, Biotechnology Healthcare, 2008 Today, this number has increased to over 400.Trends in FDA approval of Specialty Drugs 1990 through 2017, RJ Health, 2018

Rare diseases collectively affect 25 – 30 million Americans and nearly two million Americans are diagnosed with cancer each year.FAQs About Rare Diseases, Genetic and Rare Diseases Information Center, U.S. Department of Health and Human Services, 2017,Cancer Statistics, National Cancer Institute, 2018 Many of these patients are suffering with few and limited treatment options; however, between 2019 and 2023, it is projected that 65 percent of new drug launches will be specialty therapies, many indicated for rare diseases and cancer.The Global Use of Medicine in 2019 and Outlook to 2023, IQIVIA Institute, 2019

A consensus definition for what makes a particular medication specialty does not yet exist. According to the Centers for Medicare and Medicaid Services, generic or brand-name Part D drugs with average wholesale acquisition cost exceeding a $670 per month threshold are eligible for specialty tier placement.Announcement of Calendar Year (CY) 2018 Medicare Advantage Capitation Rates and Medicare Advantage and Part D Payment Policies and Final Call Letter and Request for Information, Center for Medicare and Medicaid Services, 2017

While high cost is a consistent feature of specialty medications, they can also be highly complex, requiring unique administration (e.g., nebulizer, injections, infusions at designated sites of care) and distribution (e.g., cold-chain distribution). Other specialty characterists can include consistent patient monitoring through lab tests or regular checkups and time-intensive processes, including enrollment documentation, benefit verification (i.e., coverage determination, medical or pharmacy benefit) safety and educational components, PA as well as risk evaluation and mitigation strategies (REMS).

Patients prescribed specialty medications often experience three major pain points of access, affordability and adherence. The process for receiving a specialty medication is not as simple as walking into a retail pharmacy with a prescription. Given the expense and complexity of specialty medications, both payers and life science manufacturers closely monitor utilization, whether to ensure clinical necessity or patient safety. Clinical and administrative requirements must be completed before patients can begin specialty therapy.

Without stakeholder support, the responsibility of coordinating care activities typically falls to patients, which can promote prescription abandonment, delay time to therapy and harm healthcare outcomes.

In several studies, patients described the time and effort required to start a specialty therapy as a full-time job – citing upwards of 30 phone calls to various healthcare stakeholders and many hours gathering information to obtain coverage.The Impact of Disease-Modifying Therapy Access Barriers on People With Multiple Sclerosis: Mixed-Methods Study, Journal of Medical Internet Research, 2018,Make MS Medications Accessible: Recommendations, National Multiple Sclerosis Society Patients also reported waiting eight weeks or more to receive their first dose of therapy – during this time, disease symptoms often progressed while patient health deteriorated.The Impact of Disease-Modifying Therapy Access Barriers on People With Multiple Sclerosis: Mixed-Methods Study, Journal of Medical Internet Research, 2018

Adherence refers to how patients take their medication as prescribed. Persistence refers to the duration of time patients remain on therapy.

A recent survey has uncovered more details regarding the patient experience while accessing specialty therapies.CoverMyMeds Patient and Provider Surveys, 2020 Of more than 500 specialty patients surveyed, 60 percent claimed that they had some difficulty in receiving their first dose of specialty therapy and 76 percent reported their personal role in coordinating care activities as involved or very involved.CoverMyMeds Patient and Provider Surveys, 2020

Over one third of these patients spent more than three hours of their personal time completing steps required to start specialty therapy and made five or more phone calls to various healthcare stakeholders.CoverMyMeds Patient and Provider Surveys, 2020 In agreement with previous studies,The Impact of Disease-Modifying Therapy Access Barriers on People With Multiple Sclerosis: Mixed-Methods Study, Journal of Medical Internet Research, 2018 some surveyed patients (nearly one in ten) reported waiting eight weeks or more to receive their first dose of therapy.CoverMyMeds Patient and Provider Surveys, 2020

Without support and guidance, patient burden related to specialty medications can lead to prescription abandonment and medication non-adherence. While still paying towards their insurance deductible, patients abandon prescriptions for specialty medications 27 percent of the time.Medicine Use and Spending in the U.S., A Review of 2016 and Outlook to 2021, IQIVIA Institute, 2017

Even when battling cancer, patients abandoned their treatment due to high out-of-pocket costs. A study analyzing nearly 40,000 insurance claims found that when out-of-pocket costs rose to $100–500, 32 percent of patients abandoned their oral oncolytic – this number increased to 50 percent when costs rose to $2,000.Association of Patient Out-of-Pocket Costs With Prescription Abandonment and Delay in Fills of Novel Oral Anticancer Agents, Journal of Clinical Oncology, 2018

For patients that have at some point missed a dose of their specialty medication (~half of survey respondents), difficulty affording the medication was the most cited reason for their non-adherence among other factors.CoverMyMeds Patient and Provider Surveys, 2020 A recent study reported adherence rates (i.e., extent to which patient takes a prescribed medication) for common specialty biologic therapies as low as 16 percent and persistence rates (i.e., duration of time patient remains on a therapy) as low as 34 percent when patients are not supported.Medication adherence and persistence in patients with rheumatoid arthritis, psoriasis, and psoriatic arthritis: a systematic literature review, Patient Preference and Adherence, 2018

Research suggests that patients with higher levels of healthcare literacy are able to more effectively navigate specialty medication access challenges by knowing how to properly identify problems and who to contact for quick resolution.The Impact of Disease-Modifying Therapy Access Barriers on People With Multiple Sclerosis: Mixed-Methods Study, Journal of Medical Internet Research, 2018 As previous healthcare experience or knowledge is relatively uncommon, many patients struggle to coordinate care on their own.

Access challenges for specialty medications extend to providers as well. In a recent survey to over 500 healthcare providers, fewer than one third expressed satisfaction with the prescribing process for specialty medications – citing multiple hours each week spent on completing documentation for patients to start therapy, confusion about where to send specialty prescriptions and uncertainty about which enrollment documents to complete.Specialty Prescribers Tell All, National Council for Prescription Drug Programs, 2019

As a result, over two thirds of providers switch to an alternative medication if they encounter a barrier during the specialty prescribing processSpecialty Prescribers Tell All, National Council for Prescription Drug Programs, 2019 – even though the original therapy may have been their preferred choice.

The State of Patient Support Services

For specialty therapies arriving to the market, support programs are recognized as essential for patient access, affordability and adherence. Traditionally, these programs employ teams of case managers that manually work to secure financial assistance for patients, communicate with healthcare stakeholders, complete reimbursement processes (e.g., benefits investigation, benefits verification, PA, etc.), track dispense of medications and provide assistance to help patients remain on therapy.

One study monitoring nearly 11,000 patients on a specialty medication recorded a 72 percent decrease in risk for therapy discontinuation and a higher probability of therapy adherence for patients enrolled in a support program, relative to unsupported patients.Impact of the Adalimumab Patient Support Program's Care Coach Calls on Persistence and Adherence in Canada: An Observational Retrospective Cohort Study, Clinical Therapeutics, 2018

Another study found that medication adherence rate was 14 percent greater and discontinuation rate was 14 percent lower for program-supported patients, leading to 23 percent lower 12-month medical costs.Impact of a Patient Support Program on Patient Adherence to Adalimumab and Direct Medical Costs in Crohn’s Disease, Ulcerative Colitis, Rheumatoid Arthritis, Psoriasis, Psoriatic Arthritis, and Ankylosing Spondylitis, Journal of Managed Care and Specialty Healthcare savings and positive patient outcome measures attributed to patient support services have been reported in several peer-reviewed studies.Impact of the Adalimumab Patient Support Program's Care Coach Calls on Persistence and Adherence in Canada: An Observational Retrospective Cohort Study, Clinical Therapeutics, 2018,Impact of a Patient Support Program on Patient Adherence to Adalimumab and Direct Medical Costs in Crohn’s Disease, Ulcerative Colitis, Rheumatoid Arthritis, Psoriasis, Psoriatic Arthritis, and Ankylosing Spondylitis, Journal of Managed Care and Specialty,Impact of adherence to biological agents on healthcare resource utilization for patients over the age of 65 years with rheumatoid arthritis, Patient Preference and Adherence, 2017,Impact of infliximab adherence on Crohn’s disease-related healthcare utilization and inpatient costs, Advances in Therapy, 2011

Based on three separate surveys to patients and providers.CoverMyMeds Patient and Provider Surveys, 2020,Patient Services – Pharma’s Best Kept Secret, Accenture, 2015

Despite evidence that patient support programs can positively affect patient outcomes,Impact of the Adalimumab Patient Support Program's Care Coach Calls on Persistence and Adherence in Canada: An Observational Retrospective Cohort Study, Clinical Therapeutics, 2018,Impact of a Patient Support Program on Patient Adherence to Adalimumab and Direct Medical Costs in Crohn’s Disease, Ulcerative Colitis, Rheumatoid Arthritis, Psoriasis, Psoriatic Arthritis, and Ankylosing Spondylitis, Journal of Managed Care and Specialty,Impact of adherence to biological agents on healthcare resource utilization for patients over the age of 65 years with rheumatoid arthritis, Patient Preference and Adherence, 2017,Impact of infliximab adherence on Crohn’s disease-related healthcare utilization and inpatient costs, Advances in Therapy, 2011 deficiencies of the traditional hub model limit patient enrollment into support services. For example, a study of 10,000 patients found that as few as one in five had heard of support programs for their prescribed medications.Patient Services – Pharma’s Best Kept Secret, Accenture, 2015

Even patients taking specialty therapies may not know about available help – a recent survey to over 500 patients on specialty therapies found that nearly 40 percent were unaware of support services.CoverMyMeds Patient and Provider Surveys, 2020 Patients rely on their providers to communicate availability of support services,Patient Services – Pharma’s Best Kept Secret, Accenture, 2015 but even provider awareness is limited – out of 400 surveyed providers in 2020, over one third were not aware of patient support services.CoverMyMeds Patient and Provider Surveys, 2020

According to 80 percent of surveyed providers, coordinating patient care for specialty medications is at least slightly difficult with over one third of providers making five or more phone calls to various healthcare stakholders per new prescription.CoverMyMeds Patient and Provider Surveys, 2020 Nearly three out of four surveyed providers reported spending at least one hour per patient per week to complete administrative work for beginning specialty medications.CoverMyMeds Patient and Provider Surveys, 2020

Poor communication and information exchange through outdated phone- and fax-based methods can also restrict healthcare stakeholder ability to rapidly coordinate care for patients and can delay time to therapy. While hub programs were designed to sit at the center of the healthcare ecosystem and unite all the disparate stakeholders necessary to start patients on specialty therapies,The Hub Services Wheel keeps Rolling Along, Pharmaceutical Commerce, 2018 broken connections can leave patients without their medications or struggling to find answers on their own.

Based on a survey to over 400 providers.CoverMyMeds Patient and Provider Surveys, 2020

Within the traditional hub model, healthcare stakeholders are siloed and lack visibility for quickly identifying outstanding patient case work. While online portals have been developed to help overcome such challenges, keeping track of individual login credentials for each site can quickly lead to provider portal fatigue and a decline in program usefulness.Combating Compassion Fatigue and Burnout: An Interview With Dike Drummond, MD, MPR the Right Dose of Information, 2018

As hub programs are primarily used within two - three years of product launch and operate via a full-time employee (FTE) cost structureHub Services Special Report 2016, Pharmaceutical Commerce, 2016 (i.e., as more patients are enrolled in a hub program, more hours are needed to complete corresponding case work), work to improve current standards and streamline patient access has been limited.

Transforming Patient Support Services Through Technology

Efforts from standards development organizations and advances in healthcare IT to create end-to-end solutions for specialty medications can improve the state of support services.

In collaboration with experts and policymakers from across the industry, NCPDP has made meaningful progress towards defining a standard workflow for specialty medications over the past two years. NCPDP's Specialty Pharmacy Work Group 18 was started in an effort to standardize industry transactions as they pertain to specialty medications, including eligibility verification, claim and service billing, predetermination of benefits, PA, data reporting and e-prescribing.Three Reasons to Join the Industry-Wide Effort to Speed Time-to-Therapy for Specialty Pharmacy, Drug Channels Institute, 2018

Standard workflow for starting patients on specialty therapies as defined by NCPDP's Specialty Pharmacy Work Group 18.

Through these efforts, a consensus workflow was developed that includes each major step required to start patients on a specialty therapy. Manually completed steps were identified as pain points or bottlenecks to efficient patient care.

Such pain points represent prime targets for healthcare IT innovation. For example, by moving the manual hub model to an existing technology platform already connected with major network stakeholders, a new patient support solution can now electronically complete more steps within the specialty workflow. This centralized network solution can allow a self-service model for specialty therapy coordination where relevant stakeholders have more visibility into the patient journey to complete all necessary steps.

Through this approach, patient intake for support services can be triggered by e-prescription at the point of prescribing so that more patients have an opportunity for care. This is a significant improvement relative to the traditional hub model wherein enrollment into support services was a manual process completed by phone call, fax or mail. Beyond enrollment, other steps within the specialty workflow are becoming electronic including HIPAA consent, financial assistance programs, clinical scheduling, benefits verification and PA.

As specialty medications can be claimed under the pharmacy or medical benefit, creating an electronic process for medical PA is challenging, but progress is being made. Approximately half of claims for specialty medications are paid through the medical benefit and the other half through the pharmacy benefit.Managing Specialty Drug Spend Under the Medical Benefit, Innovations and Automation for More Effective Management, CVS Health Payor Solutions, 2017

Leveraging an existing provider platform can help to achieve viral provider awareness and adoption of new electronic patient support services. Through such an approach, established network connections give access to an active user base that can be transitioned to the new technology for specialty medication access.

Altogether, electronic support services can act as non-dispensing pharmacies, where specialty prescriptions are efficiently cleaned on the frontend (i.e., administrative work is completed) and then sent to an appropriate specialty pharmacy for dispense to patients on the backend.

For more details on how tech-enabled patient support can help more patients access, afford and adhere to their specialty medications, read our 2020 report on specialty patient support.

Conclusion: Network Implications and Opportunities

Along the patient journey, medication access barriers create interruptions to care that can lead to prescription abandonment and medication non-adherence.

As indicated through market research and survey data, rising financial pressures, restricted choice, administrative bottlenecks and limited support are keeping patients from the medications they need to live healthy lives. Healthcare IT solutions offer strategies to overcome many of the challenges facing patients. For the entire network to return the most value from new technology, integration and adoption are key. By promoting awareness and installing operational changes, industry stakeholders can drive behavioral changes and meaningful use to help more patients.

For more detailed analysis on each medication access solution, download our individual reports on prescription decision support, electronic prior authorization and specialty patient support, where we take a closer look at network contributions, benefits and participation. Please direct any inquiries to medicationaccessreport@covermymeds.com.

Research Methodology

Surveys to patients and providers were conducted over a four-week period during November and December of 2019. A minimum threshold of 400 responses was used to achieve statistical significance during data analysis.

The patient survey was completed in collaboration with Snow Companies LLC, included a $20 cash incentive for completion and leveraged the network of PatientWorthy.com to better reach patients with rarer diseases more likely to take specialty medications. The survey was separated into two sections querying patients’ experiences with retail and specialty medications, respectively. Approximately half of surveyed patients reported to have at some point taken a specialty medication, which were defined as high-cost therapies for treating rare or chronic conditions that can require additional patient education/support and unique administration (e.g., oral, injection, infusion). Patients without experience with specialty medications were directed to end the survey before the specialty-specific section.

The provider survey leveraged the network of CoverMyMeds, which includes over 700,000 providers, and no incentive was applied.

Market research was conducted by CoverMyMeds and involved literature review of reputable sources as well as focus group discussions with patients and industry stakeholders.